ACA Code Cheatsheet

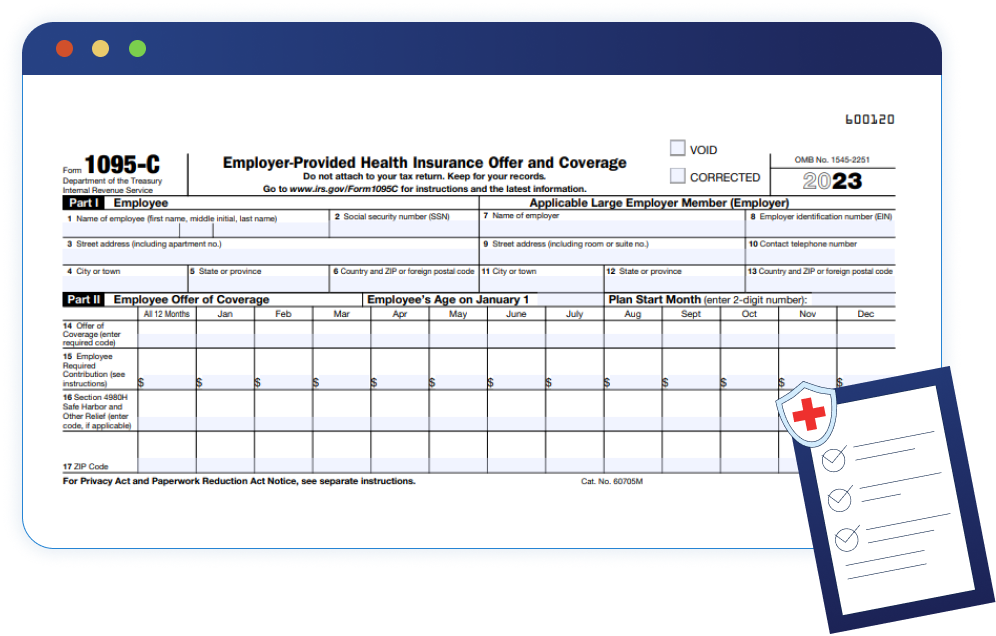

One of the most important aspects of Form 1095-C is to report the information about the health coverage offered to employees. The IRS has designed the Code Series 1 and Code Series 2 to provide employers with a way to describe the offers of health coverage on each Form 1095-C.

The IRS will review the codes used and make sure you are compliant with your employer mandate ACA requirements. To help applicable large employers who are not aware of ACA codes, ACAwise has created this quick guide.

This guide is all about:

- ACA Reporting Requirements

-

ACA Code Series

- Code Series 1 - Line 14

- Code Series 2 - Line 16

-

New changes in ACA Codes

- Codes that reflect ICHRA Coverage

About ACAwise

ACAwise is one the leading IRS AIR certified partners which provides a customized ACA compliance and reporting solution for Applicable Large Employers and Third Party Providers. With over 5+ years expertise in handling ACA reporting and generating accurate codes for businesses from different sectors, ACAwise is now ready to process the reporting needs for the 2024 tax year.